child tax credit portal phone number

If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you should have received from the IRS in June. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

The amount you can get depends on how many children youve got and whether youre.

. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. The credit amount was increased for 2021.

2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Upload your photos using your phone. Enter your information on Schedule 8812 Form.

Select the link and follow the instructions. Call the IRS about your child tax credit questions from the below phone number. You will reach an IRS assistor who can.

Call the appointment phone number for. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Child Support hours are 830 am.

The IRS will pay 3600 per child to parents of young children up to age five. Making a new claim for Child Tax Credit. Already claiming Child Tax Credit.

Request for Transcript of Tax Return. Get your advance payments total and number of qualifying children in your online account. For all other languages call 833-553-9895.

Ontario energy and property tax credit. IDme will send you a text message with a link to your smartphone to take photos of your ID. For more information see the Advance Child Tax Credit Payments in 2021 page on IRSgov.

These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. The credit was made fully refundable. The Child Tax Credit provides money to support American families.

For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of the line arent going to have them. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Eastern time Ontario trillium benefit.

Our phone assistors dont have information beyond whats available. Check IRS Advance Child Tax Credit Update Portal 2022 at irsgov. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional interpreters.

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Telephone agents for the following benefits and credits are available Monday to Friday except holidays from 815 am. Here is some important information to understand about this years Child Tax Credit.

Phone lines in puerto rico are open from 8 am. If you had an issue with a child tax credit payment that wasnt resolved there are a few ways to contact the IRS. How to contact the irs about the 2021 child tax credit even though families are automatically signed up they may want to change the payment type or.

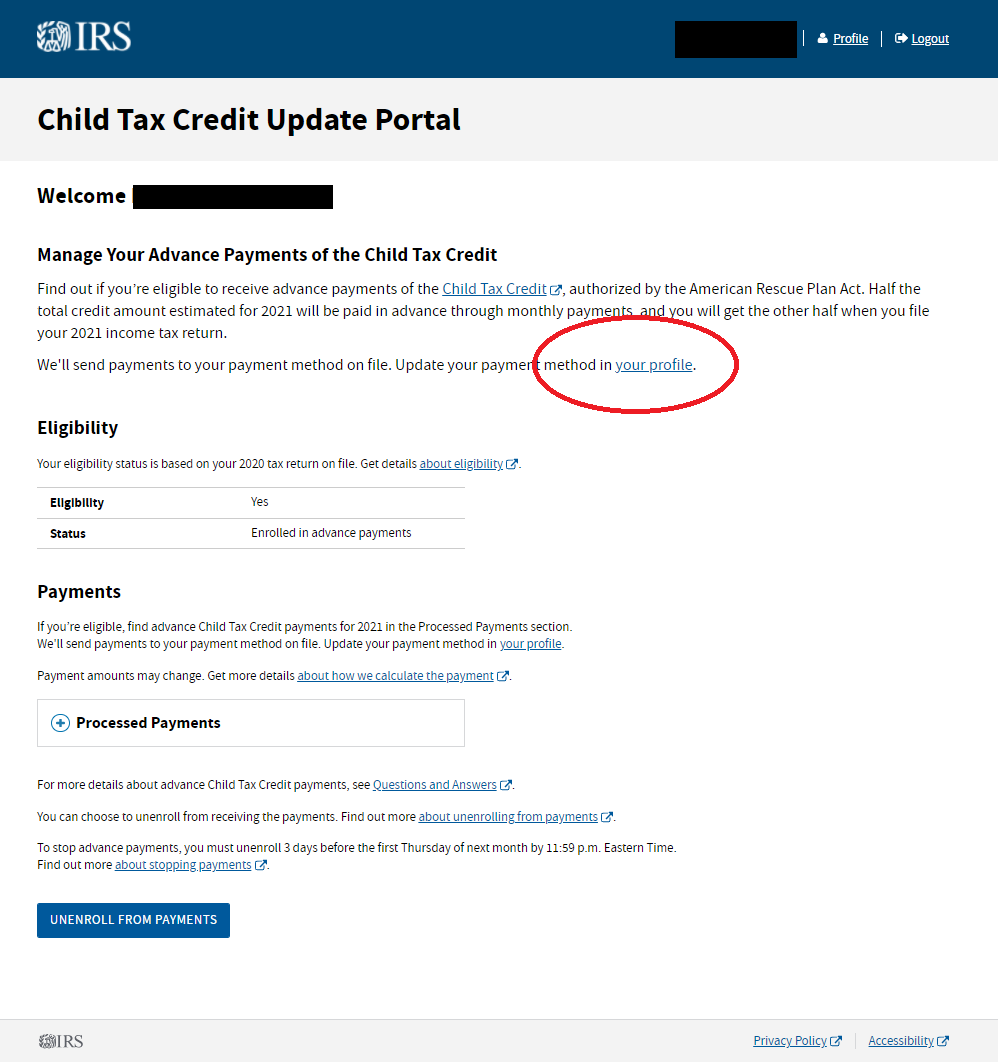

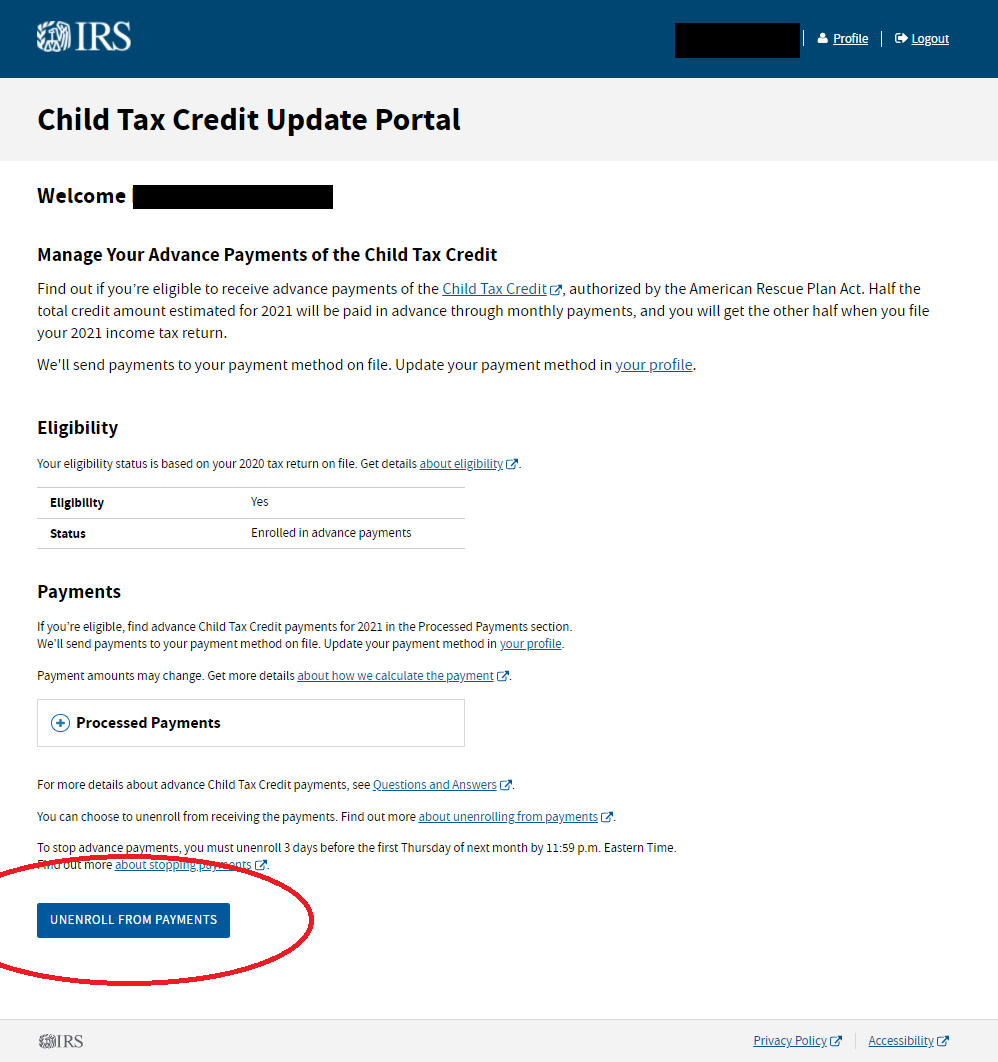

This portal closes Tuesday April 19 at 1201 am. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. The deadline to unenroll or update your information on the child tax credit update portal was 1159 pm.

Choose the location nearest to you and select Make Appointment. If you want to log in to the IRS Advance Child Tax Credit Portal without the hassle of an IDme account I found a MUCH EASIER way. For assistance in Spanish call 800-829-1040.

You should phone the HMRC on their Child Tax Credit general enquiries number 0345 300 3900 to ask for assistance before making a claim for the UK benefit. Your selfie will only be used to confirm that the person in the selfie matches the government ID. Enter in your phone number and press the blue Continue button.

The Child Tax Credit Update Portal is no longer available. Already claiming Child Tax Credit. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

617 660-1234 or 800 332-2733 toll-free in Massachusetts Division of Local Services. To be eligible for this rebate you must meet all. Specifically the Child Tax Credit was revised in the following ways for 2021.

Heres how to schedule a meeting. Ill walk you through how. After submitting photos of your document take and submit a video selfie.

By making the Child Tax Credit fully refundable low- income households will be. To reconcile advance payments on your 2021 return. Find answers about advance payments of the 2021 Child Tax Credit.

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

What Families Need To Know About The Ctc In 2022 Clasp

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Missing A Child Tax Credit Payment Here S How To Track It Cnet

2021 Child Tax Credit Advanced Payment Option Tas

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back