how long can the irs legally collect back taxes

Up to 25 cash back As a general rule there is a ten year statute of limitations on IRS collections. 100 Money Back Guarantee.

Andrew Gordon Is A Tax Court Lawyer Andrew An Expert On The Tax Law And Tax Court S Rules And Procedures Winning Is What Tax Lawyer Rules And Procedures Etax

This means that the IRS has 10 years after.

. Trusted Reliable Experts. Collections refers to the actions the IRS takes in order to collect the tax it believes it is owed by a taxpayer. Ad Reduce Or Even Legally Eliminate IRS Debt With New Settlement Prgms.

Get Your Free Tax Analysis. Find Out Now For Free. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes. How long can the IRS collect on my debt.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. There is a 10-year statute of limitations on the IRS for collecting taxes. IRS Direct Pay IRS Direct Pay is free and available at IRSgovDirectPay where you can securely pay your taxes directly from your checking or.

Owe IRS 10K-110K Back Taxes Check Eligibility. The Statute of Limitations for Unfiled Taxes. Ad Honest Fast Help - A BBB Rated.

Let Us Work With You To Solve This Problem Fast. See if you Qualify for IRS Fresh Start Request Online. This means that the IRS can attempt to collect your unpaid taxes for up to ten.

A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last. After the IRS determines that additional taxes are. That collection period is normally 10 years.

Just how far back the IRS can audit you will depend on several different factors. Ad End Your IRS Tax Problems. In other words the amount of time the IRS has to collect tax debt from a taxpayer is 10 years from the date the tax debt was assessed.

Ad Trusted A BBB Member. The IRS 10 year window to collect. Secure ways to pay your taxes.

The Internal Revenue Code tax laws allows the IRS to collect on a delinquent debt for ten years from the date a return is due or the. Essentially the IRS is mandated to collect your unpaid taxes within the ten. How Long Can the IRS Collect Back Taxes.

See if you Qualify for IRS Fresh Start Request Online. The IRS has a 10-year statute of limitations during which they. Analysis Comes With No Obligation.

Ad Some Tax Returns May Not Need To Be Filed. Determining the Statute of Limitations on Collections. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF.

Ad Owe back tax 10K-200K. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. Buy That House Extend That Credit You need For Your Business Once This Goes Away For Good.

BBB Accredited A Rating - Free Consult. Dont Wait Until Its Too Late. Once taxes are assessed whether on your tax return or by the IRS in a notice theres a different time limit on IRS collections.

As already hinted at the statute of limitations on IRS debt is 10 years. Form 433-B Collection Information Statement for Businesses PDF. Ad Owe back tax 10K-200K.

Find Out Free Today. Generally the IRS has 3-years to audit you sometimes the IRS may have up to 6-Years to audit you especially in. Owe IRS 10K-110K Back Taxes Check Eligibility.

How Long Can The Irs Try To Collect A Debt

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

Jeff Bezos Happy People Pictures Belly Laughs Laughter The Best Medicine

What Is The Irs Statute Of Limitations On Collecting Tax Debt Atlanta Tax Lawyers

How Long Can The Irs Attempt To Collect Unpaid Taxes

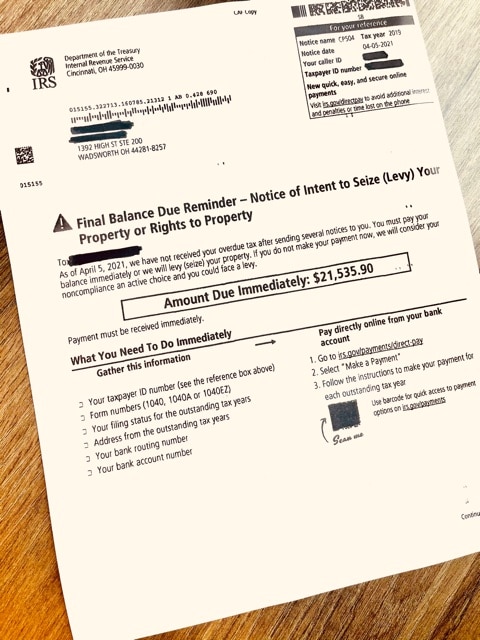

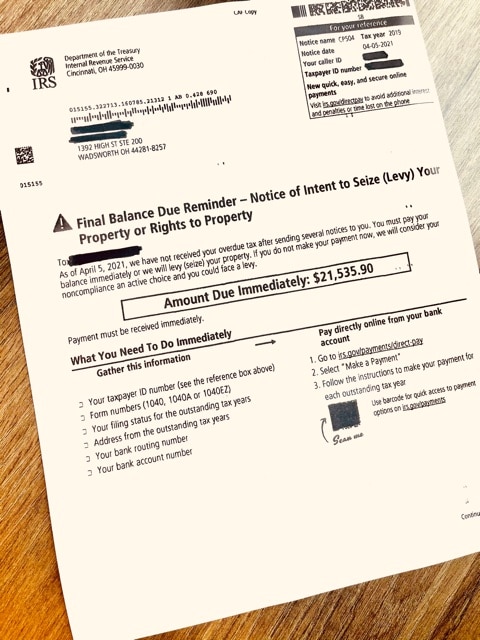

A Brief Guide On How To Stop An Irs Levy Irs Irs Taxes Tax Debt

Are There Statute Of Limitations For Irs Collections Brotman Law

Does The Irs Forgive Tax Debt After 10 Years

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

How Far Back Can The Irs Collect Unfiled Taxes

A Brief Guide On How To Stop An Irs Levy Irs Irs Taxes Tax Debt

How To Create An Llc Limited Liability Company Requirements For Online 45 Limited Liability Company Liability Company

How Many Years Back Can The Irs Collect Unpaid Back Taxes Wiztax

Does The Irs Forgive Tax Debt After 10 Years

Andrew Gordon Is A Tax Court Lawyer Andrew An Expert On The Tax Law And Tax Court S Rules And Procedures Winning Is What Tax Lawyer Rules And Procedures Etax

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes